Final Report

Prepared for FedDev Ontario December 15, 2017

Table of Contents

- Executive Summary

- 1. Introduction

- 2. Evaluation Methodology

- 3. Southern Ontario Prosperity Program

- 4. Relevance

- 5. Effectiveness

- 6. Program Design and Delivery

- 7. Conclusions and Recommendations

Management Response and Action Plan

Annexes

List of Tables and Figures

- Table 1: Evaluation of Issues and Questions

- Table 2: Number, Type and Value of Projects Approved by Program As of May 24, 2017

- Table 3: Overview of the Programs Included in the SOPP

- Table 4: Areas of Comparative Strength for Southern Ontario

- Table 5: Focus of the SOPP Programs

- Table 6: Summary of Funded Projects by Primary Focus or Objective

- Table 7: Other Programs That Share Similar Objectives to the SOPP Programs

- Table 8: Impact of FedDev Ontario Funding on the Project

- Table 9: Achievement of the Project Objectives

- Table 10: Average Rating by Program Regarding Achievement of Objectives

- Table 11: Number of Completed Projects Reporting Types of Impacts

- Table 12: Number of Projects Reporting Selected Outputs and Impacts

- Table 13: Direct Impacts of the Activities on the Beneficiary Organizations

- Table 14: Level of Agreement With Statements Regarding Program Delivery and Design – Proponents and Unfunded Applicants

- Table 15: Average Value of Projects Supported Under the Current and Previous Mandates

- Table 16: Value of Funding Approved by Year and Duration (as of May 24, 2017)

- Table 17: Average Funding Contributed From Other Sources For Every Dollar Provided By FedDev Ontario

- Table 18: Average Funding Contributed From Other Sources By Program For Every Dollar Provided By FedDev Ontario

- Table 19: Return on Contributions from FedDev Ontario to Projects Completed to Date

- Table 20: Planned and Actual G&C Expenditures Per Year and Program, 2014-15 to 2016-17

- Table 21: Planned and Actual Operating Expenditures per Year and Program, 2014-15 to 2016-17

- Table 22: Operating Expenditures as a Percent of Contribution Expenditures by Program, 2014-15 to 2016-17

- Table 23: Overview of the Hybrid Approach

- Table 24: Number of Representatives Participating in the Surveys, Key Informant Interviews and Case Studies

- Table 25: Summary of Recommended Issues, Performance Indicators and Data Sources

- Table 26: FedDev Ontario Program Alignment Architecture, 2017-18

- Figure 1: Overview of the Study Methodology

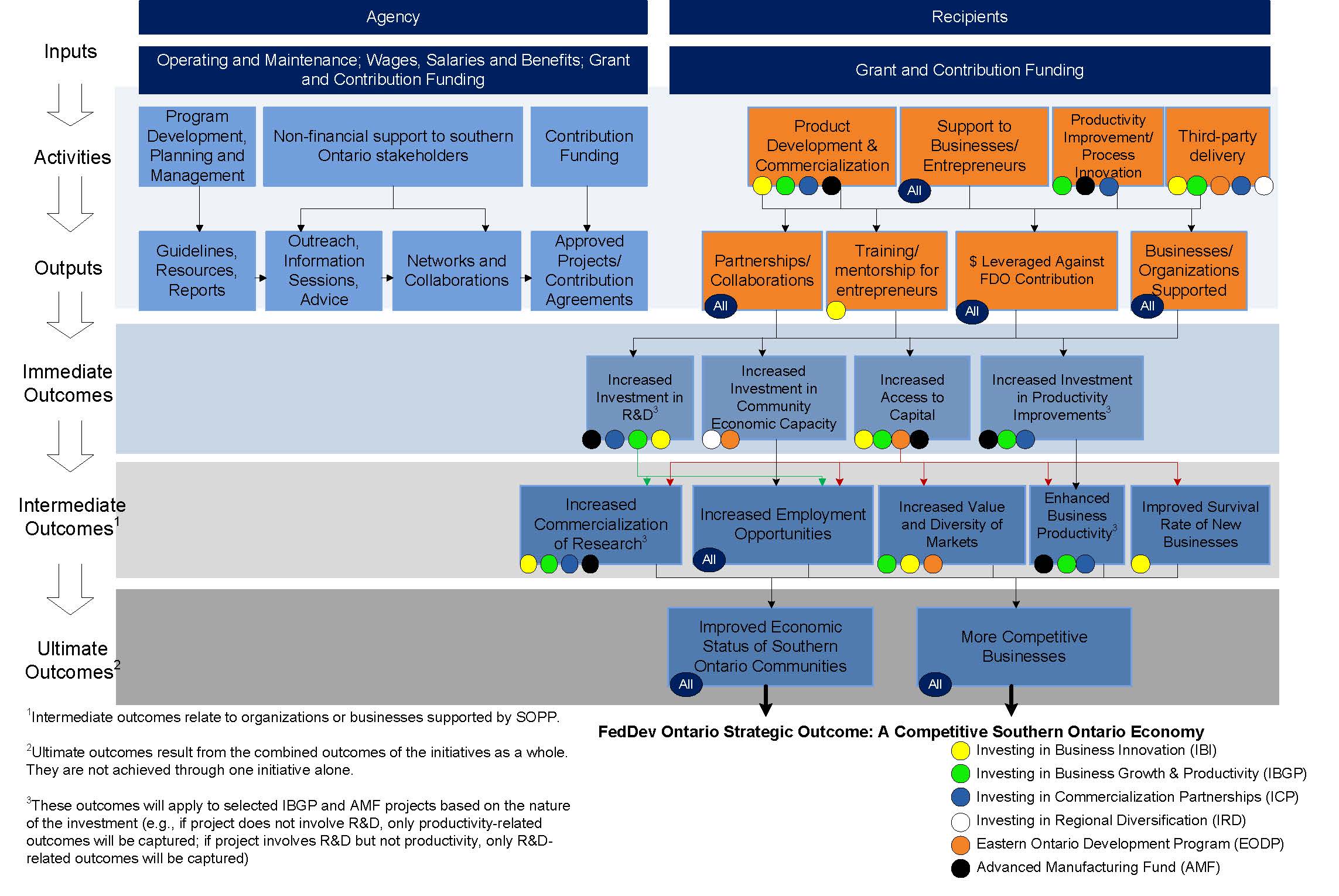

- Figure 2: Logic Model for Southern Ontario Prosperity Initiatives, Advanced Manufacturing Fund and Eastern Ontario Development Program, 2014-19

Acronyms

- AAFC

- Agriculture and Agri-Food Canada

- AIME

- Achieving Innovation and Manufacturing Excellence Program

- AMF

- Advanced Manufacturing Fund

- APMF

- Agency Performance Measurement Framework

- ARC

- Applied Research and Commercialization

- BCA

- Building a Competitive Advantage

- BDC

- Business Development Bank of Canada

- BERD

- Business Expenditures in Research and Development

- CEDP

- Collaborative Economic Development Projects

- CFDCs

- Community Futures Development Corporation

- CFI

- Canadian Foundation for Innovation

- CME

- Canadian Manufacturers & Exporters

- CIHR

- Canadian Institute of Health Research

- CSSCTP

- College Strategic Sector/Cluster/Technology Platform

- EDC

- Export Development Canada

- EODP

- Eastern Ontario Development Program

- FedDev Ontario

- Federal Economic Development Agency for Southern Ontario

- FBI

- Food & Beverage Initiative

- FDI

- Foreign Direct Investment

- FTEs

- Full-time Equivalents

- GAC

- Global Affairs Canada

- GDP

- Gross Domestic Product

- GEI

- Graduate Enterprise Internship

- G&C

- Grant and Contribution

- IBGP

- Investing in Business Growth and Productivity

- IBI

- Investing in Business Innovation

- ICP

- Investing in Commercializing Partnerships

- ICT

- Information and Communications Technology

- IRAP

- Industrial Research Assistance Program

- IRCC

- Immigration, Refugees and Citizenship Canada

- IRD

- Investing in Regional Diversification

- ISED

- Innovation, Science and Economic Development Canada

- IRID

- Investing in Regional Innovation and Development

- JPC

- Jobs and Prosperity Council

- MEDG

- Ministry of Economic Development and Growth

- MNEs

- Multinational Enterprises

- MRIS

- Ministry of Research, Innovation and Science

- NFP

- Not-for-Profit

- NRCan

- Natural Resources Canada

- NSERC

- National Sciences and Engineering Research Council

- OBIO

- Ontario Bioscience Innovation Organization

- OCC

- Ontario Chamber of Commerce

- OCE

- Ontario Centres of Excellence

- OMAFRA

- Ontario Ministry of Agriculture, Food and Rural Affairs

- ONE

- Ontario Network of Entrepreneurs

- PAA

- Program Alignment Architecture

- PAC

- Project Advisory Committee

- PE

- Productivity Enhancement

- PI

- Prosperity Initiative

- PLM

- Program Logic Model

- PSI

- Post-secondary institution

- R&D

- Research and Development

- RDAs

- Regional Development Agencies

- SDTC

- Sustainable Development Technology Canada

- SME

- Small and Medium Enterprises

- SR&ED

- Scientific Research and Experimental Development Tax

- SEB

- Scientists and Engineers in Business

- SODF

- Southwestern Ontario Development Fund

- SODP

- Southern Ontario Development Program

- SOPP Program

- Southern Ontario Prosperity Program

- SOPIs

- Southern Ontario Prosperity Initiatives

- SOSCIP

- Southern Ontario Smart Computing Innovation Platform

- SOWC

- Southern Ontario Water Consortium

- SSHRC

- Social Sciences and Humanities Research Council

- TDP

- Technology Development

- UOIT

- University of Ontario Institute of Technology

- YLF

- Yves Landry Foundation

- Y-STEM

- Youth in Science, Technology, Engineers and Mathematics

Interim Evaluation of the Southern Ontario Prosperity Program (SOPP) – Infographic

PDF version

Findings

Relevence

Government of Canada priorities

- Innovation & Skills plan

- Compliments other Government of Canada programs

Impact

- $2.45 leveraged for every $1 invested

- 10,000 FTEs created

- $2.54 increase in revenue for every $1 invested

- 2,900 business supported

- $2.38 in angel investment for every $1 invested

Expected Future Impact (including on-going projects)

- 33,000 FTEs created or maintained

- $4 B in North American sale

- $600 M in exports

- $150 M in angel investment

- Commercialization of 1,500 new products and technologies

Scope

- Eastern Ontario Development Program (EODP)

- Advanced Manufacturing Fund (AMF)

- Investing in Business Innovation (IBI)

- Investing in Business Growth and Productivity (IBGP)

- Investing in Commercialization Partnerships (ICP)

- Investing in Regional Development (IRD)

- 190 projects approved

- Up to $688 M invested

- 66% of projects still in progress as of May 24, 2017

Methodology

Secondary Lines of Evidence

- Document & literature review;

- Review of program & operational data

Surveys

61% response rate.

- 117 approved projects

- 40 non-approved projects

- 28 potential applicants

- 356 beneficiarie

Case Studies

- 6 completed

Interviews

- 64 completed

Going Forward

- Move to longer term ongoing funding mode

- Maintain fundamental program structure; continue to align with Government of Canada priorities

- Streamline application process

- Continue development of program officers

- Review and revise project reporting system

Executive Summary

Purpose and Method of Study

In August 2009, the Government of Canada created the Federal Economic Development Agency for Southern Ontario (FedDev Ontario) with a mandate to strengthen southern Ontario's economic capacity for innovation, entrepreneurship and collaboration, and promote the development of a strong and diversified southern Ontario economy. The Southern Ontario Prosperity Program (SOPP) served as the Agency's core program for its second five-year mandate (2014–15 to 2018–19). The SOPP consists of the Eastern Ontario Development Program (EODP), the Advanced Manufacturing Fund (AMF) and four programs under the Southern Ontario Prosperity Initiatives (SOPIs): the Investing in Business Innovation (IBI) initiative; the Investing in Business Growth and Productivity (IBGP) initiative; the Investing in Commercialization Partnerships (ICP) initiative; and the Investing in Regional Diversification (IRD) initiative. As of May 24, 2017, 190 projects had been approved under these programs, with approved funding totaling $688 million.

The purpose of this study was to conduct an interim evaluation of the SOPP, with a focus on its relevance, effectiveness, and design and delivery. This evaluation used a hybrid team approach (involving internal evaluators from FedDev Ontario and external consultants from Goss Gilroy Inc.) in implementing a mixed-methods research design involving multiple lines of evidence. Key lines of evidence included document and literature reviews (focused primarily on program relevance); project and program financial data; surveys of 117 project proponents, 40 applicants not approved for funding, 28 representatives from organizations eligible to apply for funding but which did not, and 365 beneficiary organizations that received financial or other assistance funded by FedDev Ontario but delivered by a third-party organization; interviews with 64 key informants; and case studies of six projects.

This is an interim evaluation. Data will not be available on the full impacts of the projects for several years. Of the 190 projects, only 34 percent were completed at the time of the evaluation and the completed projects are expected to continue generating impacts that extend beyond the term of their funding. Recognizing that only limited data is available to date on project outcomes, the evaluation also incorporated an extensive review of projected results to illustrate the impacts expected to be generated, reviews of progress reports, case studies of a sample of on-going projects, and a review of three recent FedDev Ontario studies which examined the longer-term impacts of a sample of past projects funded by FedDev Ontario.

Relevance

There is a continued need for the programs included in the SOPP. Key informants attribute the strong need to the importance of the Ontario economy, the significant opportunities for further growth and diversification that exist across a range of existing and emerging clusters, and the key challenges and constraints that are slowing this growth and diversification and need to be addressed. Project proponents, unfunded applicants, non-applicants and beneficiaries rated the need as high, noting how the programs help address challenges to economic development such as the need for capital and assistance for issues such as technology development and adoption, testing and commercialization, market development, staff development and training, business start-up and early stage development.

The SOPP programs are well aligned with each other and other programming available in southern Ontario, the constraints to development and needs of the key target groups. Taken together, the suite of SOPP programs employs a variety of delivery mechanisms to promote growth and diversification across various stages of businesses development, economic clusters, and regions within southern Ontario. Factors such as the place-based nature of FedDev OntarioFootnote 1, the strong demand for funding, and coordination between FedDev Ontario and other programming organizations help to ensure that the SOPP programs complement rather than duplicate other federal or provincial government programs that promote innovation, business development and community development. The SOPP also supports the framework for the Innovation and Skills Plan (ISP) as well as Investing in Regional Innovation and Development (IIRD)Footnote 2.

Effectiveness of the Programs

FedDev Ontario has made significant investments that are incremental and leveraged funding from other sources. FedDev Ontario funding fills a need that would not have been met by other programs. Only 4 percent of the projects would have proceeded as planned in the absence of FedDev Ontario funding. Each project dollar contributed by FedDev Ontario was leveraged with $2.45 in funding from other sources. The funding has targeted a range of existing and emerging economic clusters including manufacturing (associated with 60 percent of approved FedDev Ontario contributions, of which 37 percent could be categorized as advanced manufacturing), health care and biotech (26 percent), Information and Communications Technology (ICT) (13 percent), agri-food (8 percent) and clean tech and clean resources (7 percent).

The projects have contributed towards achievement of the priorities of the Government of Canada, including the Innovation and Skills Plan, as well as the mandate of FedDev Ontario. The investments have helped to:

- Attract, develop and retain highly skilled workers, researchers and entrepreneurs;

- Strengthen the regional innovation ecosystem through the further development of research and development capacity investments in technology development, testing and commercialization;

- Facilitate the development of collaborations and partnerships;

- Accelerate the start-up, early development, expansion and modernization of companies by attracting and facilitating investment;

- Support technology adaptation, adoption and commercialization;

- Support advisory services and market development activities; and

- Attract anchorFootnote 3 firms; and support community economic development and diversification.

The activities supported under SOPP have directly contributed to the Agency's core mandate of strengthening southern Ontario's economic capacity for innovation, entrepreneurship and collaboration and promoting development of a strong and diversified southern Ontario economy. The 65 projects which have been completed to date report increased sales of $241 million ($2.54 in increased revenues for every dollar provided by FedDev Ontario) while the 125 projects that are still ongoing are projected to generate $3.7 billion in increased North American sales, almost $600 million in export sales outside North America and nearly $1.1 billion in sales from the commercialization of 1,500 new products and technologies.

The impacts of the projects will continue to grow over time. Most projects resulted in improvements to operations, facilities, equipment and business practices or further development of the innovation capacity, the benefits of which will continue on well beyond the end of the project.

Program Design and Delivery

Most project proponents are satisfied with the design and delivery of the programs. Proponents report satisfaction in their dealings with FedDev Ontario staff and believe the design and delivery of the programs is appropriate, they were given sufficient time to complete the project, they received clear direction regarding the development of their proposal, and the application requirements and criteria are appropriate. The most significant concerns are the length of the application and approval process, the unpredictability of the timing of these steps, the reporting requirements, and usefulness of the performance measurement data. Given they invested in the process but were not successful in accessing funding, non-funded applicants tended to be less supportive of program design and delivery, particularly the length of the approval process, their dealings with FedDev Ontario staff, and the guidance and direction provided to them with respect to the preparation of their proposal.

Operating costs as a percent of grants and contributions are low relative to historical figures for the programs. Operating expenditures averaged 4.9 percent of program expenditures to March 31, 2017. Two factors contributing to the low percentage are an increase in average approved contributions per project and increased use of third parties to administer programs. Some reservations, from within the organization and externally, were expressed that the programs' operating budgets may have become too lean, particularly given the large number of legacy files that still require monitoring. Staffing constraints can slow the processing of applications; contribute to data challenges; increase staff turnover; and impact project monitoring.

The most serious issue regarding program design involves the five-year funding profile of FedDev Ontario. Three quarters of the funding (to May 24, 2017) was approved for projects of more than three years in duration. The five-year timeline means that most projects needed to be approved early in the mandate and little funding remained available for approvals in the later years. The five-year mandate also creates significant workload issues for program staff, particularly in the first year of the new mandate. During the first year, program staff are engaging with prospective applicants, and reviewing and processing applications with a particular focus on the larger scale, multi-year projects which tend to be more complex in nature. At the same time, the staff must also deal with legacyFootnote 4 projects from the previous mandate, reviewing final reports, conducting site visits, validating reported results, and preparing close-out reports. These challenges are further complicated by having program budgets divided relatively evenly across the five-year period. Reflecting the time required to approve, contract and launch new projects, actual program expenditures amounted to only 38 percent of the planned expenditures in 2014-15.

Recommendations

The recommendations arising from the evaluation are as follows:

- Develop a formal plan for addressing the issues related to the five-year funding profile. The preference is to move to a longer-term funding model for the Agency or, if that cannot be achieved, take steps to mitigate some of the impacts. Mitigating measures could include (1) having additional trained staff resources in place for the first year of the new mandate so that the Agency is better able to process and approve new projects while still being able to effectively monitor and close-out legacy projects; and (2) allocating the program budgets so that planned expenditures are lower in year one than in subsequent years. Another option for subsequent years may be to move to a rolling funding model where FedDev Ontario secures funding for additional years part way through its next mandate, such that the program always has three to five years of funding remaining.

- Maintain the same fundamental program structure for the next mandate, while exploring opportunities to refine and consolidate programs to address the current challenges and needs of the region. There is strong support within and outside the organization for maintaining the existing program structure given that the existing suite of programs is effectively designed, coordinated and delivered and doing so will enable the Agency to build off program awareness created over the past four years. Individual programs may need to be adjusted or adapted somewhat to reflect changing priorities of the federal government, the role of FedDev Ontario within ISED, and issues identified in the evaluation.

- Offer potential applicants a single point of entry and regularly update publicly available information related to funding availability and timelines. It can be difficult for potential applicants to determine under which, if any programs, they may be eligible. An online form could be used to assess eligibility and guide prospective applicants to the appropriate program. Applicants also requested that additional information be publicly available on service standards, the balance of funding available for project approvals, the success rate of applications, and the range in timelines to decision.

- Support the continued development of project officers. Program results can be directly impacted by the experience, knowledge and expertise of the project officers. The level of turnover has been high. A strategy should be developed to both reduce the level of turnover in the positions and accelerate the professional development of project officers through mechanisms such as the Professional Practice pilot. Consideration could also be given to augmenting internal resources by contracting with one or more outside agencies to assist in the review of certain aspects of project applications.

-

The project reporting system should be reviewed and revised, both in terms of the reporting process and the indicators on which proponents report. Consideration should be given to fully digitizing project files from cradle to grave (from expressions of interest to submission and review of proposals, implementation of projects, and project monitoring). The existing system of scanned documents and multiple excel files is cumbersome for applicants, proponents, officers, evaluators, and decision-makers; requires regular reentering of data; complicates validation; and restricts the ability to report on projects, proponents, and progress at the program and Agency level.

The performance indicators should be refined to reflect the new departmental results framework and facilitate useful reporting on a broader range of results relevant to specific projects. An online system could enable the proponent to more easily report on key departmental results as well as indicators specifically relevant to their project (using skips patterns to adapt the indicators by project), which could then be validated (e.g. using automated procedures and personal follow-up where needed). The data could be rolled up easily to report on results by program, region, or sector or whatever parameter is of interest to FedDev Ontario managers on an on-going basis or in response to specific requests.

1. Introduction

1.1. Background

The Government of Canada created the Federal Economic Development Agency for Southern Ontario (FedDev Ontario) in 2009 with a mandate to strengthen southern Ontario's economic capacity for innovation, entrepreneurship and collaboration; and promote the development of a strong and diversified southern Ontario economy. The Southern Ontario Prosperity Program (SOPP), which served as the Agency's core program for its second five-year mandate (2014–15 to 2018–19), consists of the Eastern Ontario Development Program (EODP), the Advanced Manufacturing Fund (AMF) and the four Southern Ontario Prosperity Initiatives (SOPIs): Investing in Business Innovation (IBI); Investing in Business Growth and Productivity (IBGP); Investing in Commercialization Partnerships (ICP); and Investing in Regional Diversification (IRD).

1.2. Purpose of the Evaluation

The objective is to conduct an interim evaluation of the SOPP. Under the 2016 Policy on Results, evaluations are to be planned with consideration of using relevance, effectiveness and efficiency (design and delivery) as primary evaluation issues, where relevant to the goals of the evaluation (Directive on Results, C.2.2.1.5). For this evaluation, a series of evaluation questions were developed and grouped under those three issues.

| Issue | Evaluation Questions |

|---|---|

| Relevance |

|

| Effectiveness |

|

| Design and Delivery |

|

This evaluation will enable FedDev Ontario to meet with the requirements of the Policy on Results, Transfer Payment Policy, and Section 42.1of the Financial Administration Act as well as contribute to renewal of the Agency mandate.

1.3 Structure of the Report

Chapter 2 summarizes the evaluation methodology. Chapter 3 provides a description of the programs involved in the SOPP and the projects which were funded. Chapters 4, 5 and 6 summarize the findings of the evaluation regarding relevance, effectiveness, and program design and delivery. Chapter 7 presents the conclusions and recommendations arising from the interim evaluation.

2. Evaluation MethodologyFootnote 5

2.1 Approach and Lines of Evidence

The evaluation was undertaken in three phases: planning, data collection involving various lines of evidence, and analysis and reporting (draft and final report). The planning phase involved a documentation review (on FedDev Ontario, the programs, and funded projects to identify the data available) and development of the evaluation matrix, methodology, data collection instruments and communication protocols. The data collection phase employed a hybrid team approach (involving internal evaluators from FedDev Ontario and external consultants from Goss Gilroy Inc.) in implementing a mixed-methods research design involving multiple lines of evidence.

Figure 1: Overview of the Study Methodology

As indicated above, the lines of evidence included a document and literature review (focused primarily on issues related to relevance); a review of project and program financial data; surveys of 117 proponents, 40 applicants not approved for funding, 28 representatives from organizations eligible to apply for funding but did not, and 365 beneficiary organizations that received financial or other assistance from third-parties which received funding from FedDev Ontario; interviews with 64 key informants; and case studies of six projects. The results were then analyzed to prepare the draft and final reports.

2.2 Challenges and Mitigation Strategies

The major challenge associated with this interim evaluation is that not enough time has elapsed for the impacts of the projects to be fully realized. Of the 190 projects, only 34 percent were completed at the time of the evaluation, and most completed projects will require additional time post-completion to realize their full impacts. To augment the limited data available to date on project outcomes, the evaluation team conducted an extensive review of the projected results to illustrate the impacts expected to be generated, conducted a review of progress reports, and focused the case studies primarily on on-going projects. The evaluation team also reviewed the results of three recent FedDev Ontario studies, which involved examining the longer-term impacts of some past projects funded by FedDev Ontario.Footnote 6

The potential non-response error was addressed by achieving significantly high response rates for the surveys, while the potential for respondent bias was addressed by including a survey of organizations that applied but did not receive FedDev Ontario funding, a survey of potential applicants, and interviews with key informants not directly involved in the programming, as well as triangulating the results with data obtained through other lines of evidence. Given these mitigation measures, the evaluation team is of the opinion that the limitations of the study were adequately addressed and the results of the evaluation are deemed to be reliable and valid.

3. The Southern Ontario Prosperity Program

3.1 Number and Value of Projects Approved

As of May 24, 2017, 190 projects (totaling $688 million in funding) were approved under the SOPP programs. These included 113 private sector projects and 77 not-for-profit (NFP) projects undertaken by other organizations (not-for-profit organizations, post-secondary institutions and other government organizations).

| Initiative | For Profit Organizations | Non-profits and Post-Secondary | Total | |||

|---|---|---|---|---|---|---|

| Number | $ million | Number | $ million | Number | $ million | |

| Southern Ontario Prosperity Initiatives | ||||||

| Investing in Business Innovation | 56 | $34.8 | 32 | $44.6 | 88 | $79.7 |

| Invest. in Business Growth & Prod | 49 | $175.9 | 2 | $29.0 | 51 | $204.9 |

| Investing in Commercialization Part. | - | - | 12 | $123.8 | 12 | $123.8 |

| Investing in Regional Diversification | - | - | 12 | $63.4 | 12 | $63.4 |

| SOPP Strategic Project | - | - | 1 | 8 | 1 | 8 |

| Advanced Manufacturing Fund (2013-2018) | ||||||

| Advanced Manufacturing Fund | 8 | $140.0 | 1 | $20.0 | 9 | $160.0 |

| Eastern Ontario Development Program (2014-19) | ||||||

| EODP | 17 | $48.0 | 17 | $48.0 | ||

| Total | 113 | $350.7 | 77 | $336.8 | 190 | $687.8 |

3.2 Overview of the ProgramsFootnote 7

Characteristics

The characteristics of the each of the six programs included in the SOPP are summarized in the table on the following page and in the points below:

- Investing in Business Innovation (IBI) provides support for mentorship, entrepreneurial support and financing to help new and early staged businesses grow and succeed. The objectives are to foster a culture of entrepreneurship focused on innovation by supporting start-ups to transform ideas into globally competitive products and services; increasing, stimulating and leveraging private sector investment; strengthening angel networks; and supporting mentorship and skills development activities to help start-ups grow and succeed. Of the 88 IBI projects, 56 supported SMEs, 22 supported angel investor networks and 10 supported not-for profit organizations which, in turn, provided support for skills development and seed funding to entrepreneurs and SMEs.

- Investing in Commercialization Partnerships (ICP) supports business-led partnerships with a focus on developing globally-competitive products and services. ICP works to increase collaboration among businesses, post-secondary institutions (PSIs) and research organizations to narrow the gap between innovation and commercialization, increase the capacity of existing and emerging innovation ecosystems, and promote the development of competitive economic clusters in southern Ontario. All ICP 12 projects involved not-for-profit organizations (including 7 PSIs). The projects support five of the six priority areas announced in the Innovation and Skills Plan in Budget 2017Footnote 8.

- Investing in Business Growth and Productivity (IBGP) focuses on established southern Ontario businesses that have the potential to be global players. The IBGP helps businesses diversify markets and expand facilities, adopt new technologies and processes to improve productivity, and increase business capacity to grow and diversify markets. The objective is to position southern Ontario businesses to be more competitive globally by assisting established businesses with high growth potential; increasing investment in technologies and processes to improve productivity; and increasing the capacity of businesses to participate in global markets through exports and integration in global value chains. Of the 51 projects approved, 49 directly supported SMEs while two supported not-for-profit organizations which, in turn, assisted SMEs with productivity improvements or increased participation in global markets.

| Program | Focus | Stage | Projects | FDO Approved | Proponents | Support | Focus of Supported Projects |

|---|---|---|---|---|---|---|---|

| IBI | Matched investment funding | Start-up/Early stage | 56 | $34.8 million (avg. $621,000) | SMEs under 50 employees |

|

|

| Angel investment networks | Start-up/Early stage | 22 | $7.5 million (avg. $340,000) | Angel investment networks |

|

|

|

| Skills Development & seed funding | Start-up/Early stage | 10 | $37.1 million (avg. $3.7 million) | Not-for-profits (1 PSI and 9 non-profits) |

|

|

|

| ICP | Businessled development/ commercialization of products and services | Product Development and Commercialization | 12 | $123.8 million (avg. $10.3 million) | Not-for-profits including 7 post-secondary institutions |

|

|

| IBGP | Direct assistance to SMEs for growth/modernization | Growth | 49 | $175.9 million (avg. $3.6 million)Footnote 9 | SMEs (15 to 1000 employees) |

|

|

| Assistance for manufacturers delivered through NFPs | Growth | 2 | $29.0 million (avg. $14.5 million) | Not-for-profits (industry associations or regional development organiz-ations) |

|

|

|

| IRD | Regional development and diversification | Early stage and Growth | 12 | $63.4 million (avg. $5.3 million) | Not-for-profits (regional development organiz-ations) |

|

|

| AMF | Increase productivity and competitiveness of advanced manufacturers | Growth | 8 | $140 million (avg. $17.5 million) | Established profitable businesses with R&D in Ontario |

|

|

| Growth | 1 | $20 million | Not-for-profits collaborating with an anchor firm |

|

|

||

| EODP | Business Development and Community Innovation | Mixed | 15 | $37.5 million ($2.5 million per CFDC) | 15 CFDCs in eastern Ontario |

|

|

| Collaborative Economic Development Projects (CEDP) | Mixed | 2 | $10.5 million | 2 CFDCs |

|

|

- Investing in Regional Diversification (IRD) provides unique regional assets and local expertise to attract new investment and opportunities and support the long-term development of stronger, more diverse economies in southern Ontario communities.

- Established as part of the 2013 Federal Budget, the Advanced Manufacturing Fund (AMF) supports research and innovation organizations, the private sector, PSIs and not-for-profit organizations to work together to accelerate development of large-scale, advanced technologies that will result in new market opportunities for Ontario businesses in manufacturing sectors. The objective is to increase firm productivity and enhance the competitiveness of Ontario's advanced manufacturers by addressing, within the Ontario delivery context, gaps in federal supports for advanced manufacturers; attracting projects that advance the development and/or adoption of cutting-edge technologies leading to product, process, and technological innovation; creating spillovers for manufacturing clusters and/or supply chains; and fostering collaboration between research institutes, post-secondary institutions and the private sector.

- The Eastern Ontario Development Program (EODP) was established in 2004 and has been administered by FedDev Ontario since the Agency was established in 2009. It is an economic development initiative aimed at addressing economic challenges in eastern Ontario and taking advantage of innovative opportunities in the region. The program is delivered through eastern Ontario's 15 CFDCs and promotes business development, job creation and strengthened economies in rural eastern Ontario communities. In addition, the EODP provides funding for Collaborative Economic Development Projects (CEDP) which generate benefits for multiple communities and promote broad-based collaborative economic development.

Governance

With the exception of the AMF, the SOPP programs are administered solely by FedDev Ontario. The Agency is responsible for program design, development, and promotion, review of applications, funding decisions, development and approval of contribution agreements, management of the funding agreements, project monitoring, and assessment of program outcomes.

The AMF is delivered under an MOU with Industry Canada (now ISED), which governs the review of applications. Under the MOU, FedDev Ontario retains responsibility for project approval but obtains input from ISED regarding the technical aspects (innovation), market relevance and potential spillover benefits of the proposed project. At times, ISED contracts with a private sector contractor to assist in that review. The AMF is the only SOPP program which also serves northern Ontario (one of the eight AMF projects, involving the largest contribution made to any SOPP project, was located in northern Ontario) and ISED provides support for program delivery in that region.

The contributions provided under each program are governed by contribution agreements made directly with businesses, not-for-profit organizations (including post-secondary institutions) that work with a collaborator or group of collaborators to implement the project, and third-party organizations that in turn use that funding to deliver support to businesses. The contribution agreement outlines the recipient's contractual obligation to provide information required for performance measurement and evaluation requirements.

4.0 Relevance

4.1 Need for the Program

Project proponents, unfunded applicants, non-applicants and beneficiaries each identified a continued need for the programming included in the SOPP. When asked to rate the extent to which there continues to be a need for these programs (on a scale of 1 to 5 where 1 is not at all and 5 is to a great extent), the average rating varied from 4.3 amongst non-applicants and 4.4 amongst unfunded applicants to 4.8 amongst beneficiaries and 4.9 amongst project proponents. Only 6 of the 550 people surveyed gave a rating of less than somewhat of a need; over three-quarters indicated that there was a great need. The average ratings given by the proponent and beneficiary groups were consistently high across the programs, ranging from 4.7 to 5.0.

In their responses, project proponents, unfunded applicants, potential applicants, and beneficiaries focused primarily on the need for assistance to help businesses deal with specific development constraints, highlighting the need for capital, funding to support further development or expansion of their operations, and assistance for particular issues such as technology development and commercialization, market development, staff development and training, and business start-up and early stage development. Those few respondents who provided ratings of 3 or less noted, generally, that the programming did not meet their needs (e.g., they required more funding than was available, the program did not move at the speed of business in terms of the timeline from application to the receipt of funding, low cost capital is already readily available from commercial sources and what was needed was a grant, or repayable grants programs would be better delivered by the private sector, such as a banks, rather than through government).

The demand for project funding also far exceeded the available funding. In total FedDev Ontario and its third party delivery agents received 4,215 applications for all SOPP programs between 2014-15 and 2017-18. 190 projects received funding.

Although not asked to rate the need for the programs on the same scale of 1 to 5, the key informants who were interviewed also expressed a strong need for the programs. In discussing the rationale for the programming, the key informants highlight various factors: the importance of the Ontario economy; the significant opportunities for further growth and diversification; the challenges or constraints that are slowing this growth and diversification; and the alignment between the SOPP suite of programs and those constraints; and alignment with the priorities of the Government of CanadaFootnote 10 and the mandate of FedDev Ontario. Each of these factors was confirmed in the results of the document and literature review, as further described below:

- As the largest regional economy in Canada, the health of the southern Ontario economy has a major impact on the overall health of the Canadian economy particularly in terms of manufacturing. According to Statistics Canada data, the region served by FedDev Ontario accounts for 39 percent of the Canadian population, 37 percent of its GDP, 41 percent of exports and 44 percent of business expenditures in research and development (BERD). Manufacturing is a key economic sector for Ontario, contributing nearly 13 percent of provincial GDP, 11 percent of employment (745,000 jobs), and over $170 billion in domestic exports for Ontario in 2015 (representing 86 percent of Ontario's domestic goods exports).

-

There are significant opportunities for further economic growth and diversification in southern Ontario. The Ontario economy encompasses a wide range of existing economic clustersFootnote 11 (e.g., manufacturing, finance, and ICT) and emerging clusters in areas such as health (e.g., biotech and regenerative medicine), bio-processing, agricultural technology and biotechnology, fintech, cybersecurity, big data, Internet of Things (IoT)Footnote 12, networking, and quantum computing) where the province holds comparative advantages and the potential for further growth is significant. Further development of these clusters will generate spillover economic benefits for other economic sectors and benefits for society overall in areas such as environment, security, health, evidence-based policy making and communications.Footnote 13

The rate of development within existing and emerging economic clusters is best viewed as a function of multiple factors that create the conditions for growth such as access to capital, highly qualified personnel, entrepreneurs, markets, infrastructure and other key inputs, as well as capabilities related to research, development and commercialization. Governments and others work to accelerate the rate of development by influencing the factors that drive development. Varying somewhat from cluster to cluster, some of the key areas where southern Ontario holds comparative strengthsFootnote 14 and how FedDev Ontario programs support those strengths are summarized in table 4 below.

| Area | Description | AMF | EODP | IBGP | IBI | ICP | IRD |

|---|---|---|---|---|---|---|---|

| Innovation ecosystem | Southern Ontario benefits from an extensive network of post-secondary institutions, government research labs, major research centres operated by multinational enterprises (MNEs) such as Xerox, IBM, Open Text, Cisco, Google, BlackBerry, Novartis, and Monsanto (Bayer) and is focused on areas such as telecommunications, digital technologies, health care, and biotech, numerous incubators, accelerators, and other cluster development organizations, and expanding capabilities in areas such as clinical trials, product testing, and technology demonstrations. | ||||||

| Investment in R&D | The Government of Canada is a major funder of early and later stage research through programs such as CIHR, NSERC, SSHRC, CFI, IRAP, and SDTC as well as SR&ED. Targeted investments are also made by the provincial government and the private sector (particularly, ICT which accounts for a majority of private sector investment in Ontario). | ||||||

| Market access | Some clusters benefit from access to large local markets for their products and technologies (e.g., local markets for energy or financial services), while some benefit from ready access to the US market and other export markets. | ||||||

| Skilled workers | Thirty-five post secondary institutions in Southern Ontario produce thousands of graduates and provide industry with access to needed skilled workers such as engineers, researchers and technicians. Southern Ontario is home to 45 percent of all Canadian R&D scientists and engineers. | ||||||

| Access to capital | The value of venture capital and private equity managed in southern Ontario has increased in recent years and companies in many of the sectors have received significant investments in recent years. Toronto is Canada's largest centre for private-equity activity and southern Ontario continues as a major destination for foreign direct investment (FDI) in North America. | ||||||

| Cost Competitiveness | SR&ED and provincial matching programs significantly reduce the cost of R&D for companies. Even before the recent decline in the Canadian dollar, southern Ontario benefited from significant cost advantages in areas such as labour costs. For example, Toronto was ranked as the most cost competitive North American location in terms of labor for ICT operations. | ||||||

| Business Development Support | Government, industry and not-for-profit organizations have made significant investments in the development of industry resources, networks and infrastructure. Representatives noted that southern Ontario features a business-friendly environment for start-ups and a range of organizations and programs, including accelerators and incubators that provide support to early stage companies. | ||||||

| Profile | Southern Ontario has a long history and features leading companies in areas such manufacturing, finance, telecommunications, ICT, biotech, chemistry and agri-food. |

-

However, the region also faces various challenges or constraints which can serve to slow the rate of development with the existing and emerging clustersFootnote 15. As highlighted in the document and literature review, as well as in interviews and surveys, the region tends to lag other advanced economies in terms of labour productivity which, in turn, has been attributed to factors such as lower rates of business investment in R&D, technology adoption, and investment in new machinery and equipment. Some of the other issues that were highlighted in the research included:

- While access to risk capital can be increasing, the level of investment remains lower than other competing regions (particularly the United States).

- There are challenges associated with technology transfer and spinoffs. The high level of public sector investment in R&D has not resulted in high levels of technology commercialization.

- While education levels in southern Ontario are high, there is a mismatch between the skills and experience required by companies (particularly in emerging sectors) and the available workers. The Conference Board of Canada has estimated that skills issues (including mismatches between education and market requirements) cost the Ontario economy over $24 billion per year.Footnote 16

- The rate of technological change in the economy is accelerating, which holds significant implications for businesses in terms of evolving skills requirements, the need to adapt business models, and the need to make further investments. In particular, developments such as the emergence of new platforms, systems and technologies, automation, the Internet of Things, 3D printing, big data analytics, introduction of composites and lightweight materials, and Industry 4.0 are having a major impact on traditional manufacturing.

- Most SMEs are not pursuing global markets. For example, only 7 percent of Ontario SMEs are engaged in export activities.Footnote 17

The region is also being impacted by uncertainty regarding the economic outlook. While the declining Canadian dollar benefited exports (particularly in the manufacturing sector), it also made some key imports (such as machinery and equipment) more expensive which has slowed business investment. Going forward, uncertainty associated with the dollar, the ongoing NAFTA renegotiations, the global economic outlook and the potential for interest rate hikes may negatively impact the investment climate.

-

SOPP programs are well-coordinated with each other, employing a variety of delivery mechanisms to address these challenges and constraints and promote development across various stages of businesses' development, economic clusters, and regions within southern Ontario.

Table 5 summarizes the relative focus of each of the programs in terms of the delivery mechanisms, development issues or challenges on which they focus as well as stages of business development, economic clusters and regions.

| Focus | IBI | ICP | IBGP | IRD | AMF | EODP |

|---|---|---|---|---|---|---|

| Sources: Program documentation and statistical review of approved projects | ||||||

| Approved Contribution from FedDev Ontario | ||||||

| Number | 88 | 12 | 51 | 12 | 9 | 17 |

| Value ($millions) | $81 | $132 | $179 | $69 | $160 | $48 |

| Delivery Strategy | ||||||

| Direct to business | ||||||

| Funding for not-for-profit intermediaries | ||||||

| Funding for not-for-profit organizations or PSIs | ||||||

| Stage of Business Development | ||||||

| Start-up/Early Stage SMEs | ||||||

| Growth and Modernization | ||||||

| MNEs | ||||||

| Challenges and Constraints - targets needs related to: | ||||||

| Development/expansion of manufacturing capabilities | ||||||

| Research and commercialization | ||||||

| Advisory and support services | ||||||

| Regional Development - Eastern Ontario | ||||||

| Angel investment/investment funding | ||||||

| Product, prototype or technology development | ||||||

| Market development | ||||||

| Public infrastructure developmentFootnote 18 | ||||||

| Investment attraction/business retention | ||||||

| Existing and Emerging Clusters | ||||||

| Manufacturing | ||||||

| Advanced manufacturing | ||||||

| Cleantech and clean resources | ||||||

| Health/bio-sciences | ||||||

| Agri-tech/Agri-food | ||||||

| Consumer Sector | ||||||

| ICT | ||||||

| Digital technology | ||||||

| Professional Services | ||||||

| Primary | ||||||

| Other | ||||||

| RegionFootnote * | ||||||

| Toronto | ||||||

| Regions Neighboring Toronto | ||||||

| Eastern Ontario | ||||||

| Other (including southwestern Ontario, Kingston and Ottawa) | ||||||

A description of the relative focus of the programs is provided below.

Delivery Mechanisms

FedDev Ontario employs various delivery mechanisms, including providing repayable funding directly to businesses, non-repayable funding for cluster or capacity development projects undertaken by post-secondary institutions or other not-for-profit organizations (sometimes in partnership with private sector organizations or others), and non-repayable contributions to third-party organizations (e.g., associations, research organizations, post-secondary institutions, CFDCs, or other not for-profit organizations) that, in turn, provide services and other support to business clients and others.

Stages of Business Development

The programs provide support for start-up and early stage companies, expanding and modernizing existing businesses, and increasing the involvement of MNEs in the further development of clusters in Ontario. To facilitate start-up and early stage development, IBI provides funding to SMEs to be matched with venture capital or funding from angel investors; to strengthen angel investor networks; and to not-for-profit organizations to facilitate skill development and seed financing for new entrepreneurs. ICP facilitates development, testing and commercialization of new technologies by bringing together businesses, post-secondary institutions and research organizations. IRD funds some projects that, in turn, made investments in early-stage companies.

Enhancing Ontario's productivity and growth requires increased investment in productivity enhancing advanced technologies and innovation. The IBGP and AMF have supported investments in the development and modernization of production capabilities and facilities as well as the adaptation or adoption of new technologies, materials or processes. Other IBGP and IRD projects have supported business growth through activities in areas such as market development and provision of advisory services.

Both AMF and ICP facilitated large-scale investments, including foreign direct investment in projects involving MNEs. For example, GE Healthcare indicated that, in the absence of the Centre for Commercialization of Regenerative Medicine and the funding provided by FedDev Ontario (an AMF project), they would have made their investment in regenerative medicine in another jurisdiction. Similarly, a significant investment by IBM into southern Ontario may not have been made in the absence of the SOSCIP projectFootnote 19 and, to a lesser extent, the Southern Ontario Water Consortium (SOWC) project, both funded initially under the Technology Development Program (TDP) under Mandate 1 and continuing IBM's involvement under ICP. Project funding for Hanwha L&C Inc. of South Korea is another example of foreign direct investment attraction. Hanwha received $15 million from AMF to establish London, Ontario as Hanwha's North American headquarters, paving the way for future foreign direct investment in the region.

Development Issues

The programs have targeted a wide range of economic drivers including access to capital (e.g., increasing the supply of angel investment), expansion or modernization of production capabilities, linkages and networking between groups (e.g., the ICP has brought together representatives from business, post-secondary institutions and research organizations to narrow the gap between innovation and commercialization), technology development, testing and commercialization (e.g., through ICP, IRD and AMP projects), entrepreneurial and staff development, provision of advisory services through intermediary organizations funded by FedDev Ontario, market development and investment attraction.

As part of the evaluation, descriptions of each of the 190 projects were reviewed by the evaluation team to code the projects by primary focus or objective. Of the 190, 61 projects supported the development, expansion or modernization of manufacturing facilities and accounted for almost one-half (49 percent) of the approved funding. Twelve projects provided advisory services or support to businesses (e.g., services or support related to incubation and acceleration, business or technology assessment, business training, technology or business development support, or capital access advisory services).

| Number | Approvals ($ millions) | % of FDO Funding | |

|---|---|---|---|

| Development/expansion of manufacturing capabilities | 61 | $338.10 | 49.20% |

| Research and commercialization | 12 | $119.00 | 17.30% |

| Advisory Services to Business | 12 | $89.60 | 13.00% |

| Regional Development - Eastern Ontario | 17 | $48.00 | 7.00% |

| Investment fund | 8 | $34.20 | 5.00% |

| Product, Prototype or Technology Development | 32 | $22.70 | 3.30% |

| Market development | 22 | $12.90 | 1.90% |

| Public Infrastructure Development | 2 | $9.30 | 1.40% |

| Angel Investment | 22 | $7.80 | 1.10% |

| Investment attraction/business retention | 2 | $6.20 | 0.90% |

| Total | 190 | $687.80 | 100.00% |

The survey of beneficiaries included 150 businesses, 48 community projects and 60 CEDP projects funded under the EODP; 57 businesses that received assistance through the Achieving Innovation and Manufacturing Excellence (AIME) Global Program offered by the Yves Landry Foundation (funded through IBGP); and 50 businesses that were assisted though the CME SMART Advanced Technologies for Global Growth (ATGG) program (also funded through the IBGP). An overview of the objectives of their involvement in the program is provided below:

- The EODP business projects focused on a range of objectives including expansion of business operations, training, sales and marketing, and development of new products, processes and technologies.

- The focus of the EODP community innovation projects also ranged widely from development initiatives, strategic plans and feasibility studies to local infrastructure development, and support for business development activities.

- The beneficiaries involved in the CEDP were most commonly involved in activities related to mentorship, provision of business advice, and the development of technical and soft skills.

- Participants in the CME SMART ATGG program received advanced technology assessments or support for advanced technology adaptation or adoption projects.

- Participants in the Yves Landry program received training related to the development or adaption of new technology, processes or procedures within the company.

Existing and Emerging Clusters

The evaluation team also reviewed the 190 projects to identify the clusters or sectors on which they focus. The SOPP projects involve a range of existing and emerging economic clusters, with the manufacturing sector being the most significant. Ontario is the primary centre for manufacturing in Canada, accounting for 46 percent of Canada's manufacturing GDP and 52 percent of its manufacturing exports. While conditions have been improving, manufacturing employment declined by about one-quarter between 2005 and 2015. Of the 190 projects, 77 related to the manufacturing sector (mostly funded through the AMF and IBGP with some funding also provided through the ICP and IBI). These 77 projects accounted for 41 percent of the projects approved and 60 percent of the total approved value of FedDev Ontario contributions (of which approximately 37 percent could be categorized as advanced manufacturing).

Other leading sectors or clusters include health care and biotech (27 projects accounting for about 26 percent of approved funding), ICT (44 projects accounting for about 13 percent of approved funding), agri-food (18 projects accounting for about 8 percent of funding) and clean tech and clean resources (13 projects accounting for about 7 percent of funding).

Region

Northumberland Case Study: Food Cycle Sciences Corporation in Stormont, Dundas & Glengarry

CEDP funding allowed this company to attract and retain FTEs with technical expertise from urban centres, including new Canadians.In addition, this project allowed Food Cycle Sciences to expand into global markets.

With the exception of the EODP (which is targeted specifically at communities in eastern Ontario) and the AMF (which could fund projects from all parts of Ontario)Footnote 21, the programs are open to applicants from across southern Ontario. Uptake of the programs varies by region, depending largely on where industry is based. Overall, the leading regions include Toronto ($158 million was approved for projects based in Toronto, representing 23 percent of the total) and neighboring regions (a further $148 million, 22 percent, was approved for projects in census divisions adjacent to Toronto, mostly Peel and York).

Eastern Ontario was identified as a priority for funding because of weak economic conditions which contribute to a loss of businesses, investment and youth from the region. For example, as of May 2017, the employment and participation rates in eastern Ontario are lower than in the rest of the southern Ontario (54 percent v. 61 percent and 58 percent v. 66 percent respectively as of 2017) while, in 2014, employment incomes averaged 13 percent below those in southern Ontario. Of the 190 projects, 31 targeted the eastern Ontario region (excluding Ottawa and Kingston) with contributions totaling $81 million (12 percent of the total).

- The SOPP programs are consistent with the priorities of the Government of Canada, including the Innovation and Skills Plan, as well as the mandate of FedDev Ontario. Based on the results of consultations undertaken for the Innovation and Skills Plan, the Government of Canada identified three priority areas: people (ensuring that people are equipped with the right skills and experience to drive innovation); technologies (taking full advantage of transformative emerging technologies that can elevate the competitiveness of established and new firms, industries, and clusters); and companies (growing the next generation of global companies in Canada)Footnote 22. The investments made by FedDev Ontario have been consistent with these priorities, particularly with respect to:

- Attracting, developing and retaining highly skilled workers, researchers and entrepreneurs. FedDev Ontario contributions have supported the delivery of training while proponents report that investments have helped southern Ontario attract and retain key workers, researchers and entrepreneurs.

- Strengthening the innovation ecosystem through the further development of research infrastructure (e.g., construction of new buildings, adaptation of existing buildings, and provision of equipment for new or existing centres), investments in technology development, testing and commercialization, and facilitating the development of collaborations and partnerships.

- Accelerating the start-up, early development, expansion and modernization of companies by attracting and facilitating investment, supporting technology adaptation, adoption and commercialization, supporting advisory services and market development activities and attracting anchor firms.

As noted earlier, FedDev Ontario has made significant investment in clusters identified by the Government of Canada as priorities including advanced manufacturing, health and biotech, ICT, agri-food and clean tech and clean resources. The activities supported under the SOPP have also directly contributed to the Agency's core mandate of strengthening southern Ontario's economic capacity for innovation, entrepreneurship and collaboration and promoting the development of a strong and diversified southern Ontario economy.

4.2 Relationship to Other Programming

The major findings of the evaluation regarding the relationship between the SOPP and other programming are as follows:

- Factors such as the place-based nature of FedDev Ontario, the strong demand for funding, and coordination between FedDev Ontario and other funding organizations help to ensure that the SOPP programs complement rather than duplicate other federal or provincial government programs that promote innovation, business development and community development. There are a variety of other programs available to support development in southern Ontario. When asked about other programs that are available in southern Ontario that share at least somewhat similar objectives to those of the programs included in SOPP, the key informants and those who were surveyed identified a range of different programs which are listed in the table below.

| Agency | Program/Type of Program | Early-stage | Growth | Maturity/Modern |

|---|---|---|---|---|

| Capital or Loan Programs | ||||

| BDC | Venture Capital | |||

| BDC | Growth & Transition Capital | |||

| BDC | Business Loans | |||

| IRCC | Immigrant Investor Venture Capital Pilot | |||

| IRCC | Start-up Visa | |||

| FedDev Ontario |

Community Futures | |||

| ISED | Canada Small Business Finance Program | |||

| Government of Ontario | ||||

| MEDG | Ontario Venture Capital Fund | |||

| Market/Export Development Programs | ||||

| NRCan | Expanding Market Opportunities | |||

| EDC | Export Development Canada | |||

| GAC | CanExport | |||

| Innovation | ||||

| AAFC | Agri-Innovation | |||

| Food Research and Development Centre's Industrial Program | ||||

| GAC | Going Global Innovation (GGI) | |||

| ISED | Consortium for Aerospace Research and Innovation in Canada (CARIC) | |||

| Automotive Innovation Fund | ||||

| Automotive Supplier Innovation Program | ||||

| Strategic Aerospace & Defence Initiative | ||||

| Technology Demonstration Program | ||||

| Strategic Innovation Fund | ||||

| NRC | Industrial Research Assistance Program (IRAP) | |||

| NSERC | Various programs | |||

| SDTC | Sustainable Development Technology Canada | |||

| Government of Ontario | ||||

| OMAFRA | Agri-Technology Commercialization Centre (ATCC) | |||

| Ontario Agri Food Technologies (OAFT) | ||||

| MRIS | Green Investment Fund | |||

| Regional Funding | ||||

| MEDG | Eastern Ontario Development Fund (Business Stream) | |||

| MEDG | Southwestern Ontario Development Fund (Business Stream) | |||

While the breadth of the SOPP programming creates the potential for some overlap with other programming, only a few key informants suggested that overlap exists with other programs and only one identified it as an issue (the potential for overlap between the recently announced Strategic Innovation Fund and the Advanced Manufacturing Fund). Some of the key characteristics of FedDev Ontario and its programming which enable the Agency to position its programs to complement the other available sources of assistance include:

- As a regionally-based organization, the Agency is well positioned to understand the specific needs of key target groups that are not being met by other programs. FedDev Ontario works closely with industry development organizations and companies in identifying needs in both existing and emerging clusters. It is able to deliver services at the ground level through supporting key intermediaries (such as CFDCs, industry associations, and other institutions) which provide capital and support services to both for-profit and not-for-profit organizations. Furthermore, FedDev Ontario undertakes analysis, outreach and engagement activities and periodic research (such as the consortia study completed in 2016) which further helps the Agency keep abreast of potential opportunities, issues, and constraints to development.

- By offering a range of programs, the support provided by FedDev Ontario can be tailored to meet the specific needs of clients.

- The contributions provided by FedDev Ontario allow for stacking within specific guidelines, enabling the funding to be leveraged with funding from a variety of other sources including other federal government programming and provincial programming. The co-funding arrangements enable proponents to increase their access to further funding and facilitate the sharing of risk. Approximately one-half of the other government representatives who were interviewed reported that the presence of FedDev Ontario funding for specific projects influenced their decision to provide funding or other assistance requested. Some elaborated that the commitment of FedDev Ontario provides them with an assurance that due diligence has been done and the organization or project is worthy of the investment. The presence of federal funding also brings more attention to a project and may increase opportunities to access funding from private sector investors.

- FedDev Ontario provides pathfinding assistance, referring organizations to other sources of assistance when relevant. In addition to the referral service offered by project officers, FedDev Ontario also hosts Canada Business Ontario which acts as a one-stop shop providing information and advice about available government grants and requirements, as well as other sources of financing. FedDev Ontario also works with federal partners on the Accelerated Growth Service initiative, helping high-growth firms scale-up through a coordinated and streamlined approach to accessing federal business support services.

-

Efforts have been made by FedDev Ontario to improve the level of coordination in programming across various government organizations through regular meetings and established communication channels. These efforts aim to minimize potential overlaps, clarify roles and share information. A few key informants suggested that there may be opportunities to further enhance the level of coordination between programs. For example, it was suggested that applicants and proponents would welcome efforts to ease the administrative burden by achieving greater standardization across government programs with respect to application requirements, stacking limits and reporting requirements.

Another issue that was identified relates to the inconsistent treatment by CRA of repayable loans for tax purposes. In some situations, CRA treats the repayable loans provided by FedDev Ontario to businesses as a grant rather than as a loan, which can increase the taxable income of the proponent and reduce their eligibility for a SR&ED Tax Credit. This issue was also raised in the evaluation of the Southern Ontario Development ProgramFootnote 23. FedDev Ontario has discussed this issue with CRA extensively who has recommended that our program officers should advise clients to seek expert advice on the potential tax implications of the funding they receive from FedDev Ontario.

- SOPP fills needs that would not be met by other programming. Only 4 percent of projects would have gone ahead as planned in the absence of FedDev Ontario funding. As indicated in the table below, most proponents indicated that the project would have been reduced in scope (44 percent), implemented over a longer period of time (33 percent), or delayed in the absence of FedDev Ontario support. About 15 percent of proponents said they would have had to cancel the project. Only 5 of the 40 applicants not approved for funding indicated that their projects proceeded as planned in the absence of FedDev Ontario support.

| Question: Proponents: If FedDev Ontario had not been able to provide funding for the project(s), what would your organization most likely have done? OR Unfunded: What happened to the proposed project when you were not able to obtain funding from FedDev Ontario? (select all that apply) | ||||||

| Proponents | Unfunded | Total | ||||

|---|---|---|---|---|---|---|

| # | % | # | % | # | % | |

| Total Respondents | 117 | 100.00% | 40 | 100.00% | 157 | 100.00% |

| Proceeded with the project as planned | 5 | 4.30% | 5 | 12.80% | 10 | 6.40% |

| Reduced the scope of the project | 51 | 43.60% | 25 | 64.10% | 76 | 47.80% |

| Implemented the project as planned but over a longer time period | 38 | 32.50% | 10 | 25.60% | 48 | 30.60% |

| Delayed the start of the project | 31 | 26.50% | 17 | 43.60% | 48 | 30.60% |

| Cancelled the project | 17 | 14.50% | 3 | 7.70% | 20 | 12.70% |

| Undertaken a different type of project Other, please specify |

9 | 7.70% | 2 | 5.10% | 11 | 7.00% |

| Approached another program for funding to replace the requested FedDev Ontario funding | 22 | 18.80% | 6 | 15.40% | 28 | 17.80% |

| Looked for private capital/investment | 10 | 25.60% | 10 | 6.40% | ||

| Other | 14 | 12.00% | 3 | 7.7%% | 17 | 10.80% |

| Don't Know | 5 | 4.30% | 1 | 0.00% | 6 | 3.80% |

| No Reply | 0 | 0.00% | 1 | 0.00% | 1 | 0.60% |

5. Effectiveness

This chapter summarizes the major findings regarding the effectiveness of the programs. It begins with an overview of the current status of the projects for contextual purposes and then reviews achievement of project objectives, impacts to date of the completed projects, projected impacts of the on-going projects, and extent to which the projects are expected to continue on and generate further impacts beyond the term of the FedDev Ontario funding.

5.1 Current Status of the Projects

Final reports and close-out reports had been filed for 65 of the 190 projects (34 percent) at the time of the evaluation. The final reports are prepared by the proponents at the conclusion of the project, adding to the progress reports prepared during project implementation. Close-out reports are prepared by project officers, typically after a site visit. The 65 completed projects tend to be of a shorter duration than the on-going projects and consisted primarily of projects funded under IBI (46 projects), IBGP (12 projects), and IRD (5 projects). The ICP, AMF and EODP projects were all multi-year projects. No ICP or EODP projects were completed and only one AMF project was completed. The other closed project was a SOPP Strategic Project.

Of the 117 projects represented in the survey, 35 (30 percent) were completed according to the proponents. No projects were identified as suspended, cancelled or yet to start. Only 6 of the 117 projects were identified as not being implemented as planned. Of those six, four reported having been delayed, three had some project partners change, three indicated the project focus had shifted somewhat, and one indicated the scope was reduced somewhat. Four of the six proponents indicated that the change impacted the effectiveness of the project (two indicated that effectiveness was enhanced and two indicated effectiveness was reduced, both of whom still rated the project as at least somewhat successful in meeting its objectives). Of those noting that effectiveness increased, one indicated that the change in strategy resulted in higher margins than projected while the other indicated timelines to commercialization were shortened because of bringing in new partners.

5.2 Achievement of Project Objectives

The proponents and beneficiaries were asked to rate how successful the project has been to date in terms of achieving its objectives, using a scale of 1 to 5, where 1 is not at all successful, 3 is somewhat and 5 is very successful. As indicated below, the average rating provided by both the proponents and the beneficiaries was 4.4.

| Question: On a scale of 1 to 5, where 1 is not at all successful, 3 is somewhat successful, and 5 is very successful, how successful has the project been to date in meeting its objectives? | ||||||

| Response | Proponents | Beneficiaries | Total | |||

|---|---|---|---|---|---|---|

| # | % | # | % | # | % | |

| 1 Not at all | 1 | 0.90% | 6 | 1.60% | 7 | % |

| 2 | 0 | 0.00% | 3 | 0.80% | 3 | % |

| 3 To some extent | 11 | 9.40% | 42 | 11.50% | 53 | % |

| 4 | 41 | 35.00% | 89 | 24.40% | 130 | 1.50% |

| 5 To a great extent | 62 | 53.00% | 177 | 48.50% | 239 | 0.60% |

| N/A | 0 | 0.00% | 0 | 0.00% | 0 | 11.00% |

| No reply | 2 | 1.70% | 48 | 13.20% | 50 | 27.00% |

| Total Respondents | 117 | 100.00% | 365 | 100.00% | 482 | 100.00% |

| Average Rating | 4.4 | 4.4 | 4.4 | |||

The average ratings across the programs ranged from a low of 4.3 amongst the IBI and IBGP proponents and CEDP beneficiaries to a high of 4.9 amongst the EODP proponents.

| Program | Average Rating | Program | Average Rating |

|---|---|---|---|

| Southern Ontario Prosperity Initiatives | Eastern Ontario Development Program | ||

| Proponents | Proponents | 4.9 | |

| IBI | 4.3 | Beneficiaries | |

| IBGP | 4.3 | EODP CEDP | 4.3 |

| ICP | 4.4 | EODP | 4.4 |

| IRD | 4.6 | EODP Total | 4.4 |

| Beneficiaries | Advanced Manufacturing Fund | ||

| IBGP | 4.4 | AMF Proponents | 4.5 |

When the few proponents and beneficiaries associated with lower rated projects were asked to identify areas where the project had been less successful than expected, the issues focused mostly on delays in project implementation caused by outside factors (e.g., delays in obtaining equipment for suppliers, regulatory issues, or in one case a fire) or by delays in the project approval process which delayed the results or required the project to be implemented in a shorter time period. Other issues that were identified related to project partners (e.g., an investor not following through with their commitments), changes in the market which required changes to the commercialization strategy, slower sales than expected, and not having enough funding to implement the project as planned.

5.3 Outputs and Impacts of the Completed Projects

The close-out reports, which are prepared by the project officer and signed off by a manager, summarize information on the proponent, project, expenditures, project outcomes, and project monitoring (e.g. site visits and audits). As part of the evaluation, a detailed review of each close-out report was undertaken to develop a database, capturing the impacts reported by each completed project. This section provides a summary of the impacts, drawn from the close-out reports and final reports, surveys, and case studies.

As indicated in table 11 below, the types of outputs and impacts most commonly reported for the projects included the creation or maintenance of permanent full-time positions, training, collaborations and partnerships, increased sales, capacity development, and the creation of intellectual property.

| Type of Impact | Projects Reporting Impact | Overview/Examples | |

|---|---|---|---|

| Number of Projects | % of Projects | ||

| Projects Completed | 65 | 100% | |

| Delivery of services to businesses and other beneficiaries | 19 | 29% |

|

| Creation/maintenance of employment | 65 | 100% |

|

| Training of entrepreneurs and staff members | 55 | 84% |

|

| Linkages and partnerships | 50 | 76% |

|

| Capacity development | 19 | 29% |

|

| Creation of IP | 28 | 43% |

|

| Increased revenue | 44 | 68% |

|

| Enhanced competitiveness and sustainability | 21 | 32% |

|

| Further development of the business and markets | 44 | 68% |

|

| Angel investments | 7 | 11% |

|

A further description of these outputs and impacts is provided in the following paragraphs, including examples of some of the impacts, largely drawn from the case studies (provided in the text boxes).

Provision of Services to Businesses and Other Beneficiaries

Nineteen projects reported providing businesses, particularly SMEs, with access to needed services, resources and other support ranging from business development services, technology development and testing services to training, capital and other resources. Most of the SOPP projects that provide significant support services to businesses are multi-year projects which are still on-going (and therefore not included in this total).